The global agro textile market was valued at approximately USD 4.62 billion in 2021 and is projected to reach USD 6.98 billion by 2030, growing at a compound annual growth rate (CAGR) of 4.7% from 2022 to 2030. The increasing need to enhance agro productivity to meet the daily demands of a growing population, along with rising product demand for improving crop quality and overall productivity, is expected to drive industry growth during the forecast period.

The COVID-19 pandemic presented various challenges related to plant management, logistics, and supply chains in some countries within the OPEC region. However, favorable government policies promoting sustainable practices in agriculture and related sectors are anticipated to boost product demand in the coming years.

Agro textiles have multiple applications, including boosting germination in nurseries, protecting soil from moisture evaporation and erosion, and safeguarding against environmental and climatic factors such as hail, rain, and sunlight. They provide protection from birds, insects, fungus, and other pests, which has contributed to increased product adoption in the U.S. Woven agro textiles, produced on weaving machines, resist shrinkage and weathering, making them ideal for moisture-prone environments.

Woven fabrics are thicker and sturdier than other textiles, making them suitable for protective applications such as packaging and ground covers. These products are utilized in various sectors, including forestry, horticulture, aquaculture, landscaping, and animal husbandry, helping to protect livestock and crops during transportation and safeguarding them from animals, insects, fungus, and weeds. Agro textiles are also employed in capturing, shading, and irrigation applications. However, the production of agro textiles is a cost-intensive process due to the high costs of raw materials, such as petroleum, and the advanced manufacturing technologies required to produce yarn from these materials. This high production cost may hinder growth to some extent.

Order a free sample PDF of the Agro Textiles Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- The Asia Pacific region dominated the global agro textile market in 2021, accounting for over 48.10% of the overall revenue. This high share is attributed to the increasing demand for agro products, driven by a rising population and changing consumer preferences. The presence of developed economies like the U.S. and Canada supports the North American market's diversity. Research and development into sustainable agricultural practices and a growing affinity for organic products are expected to further drive industry growth.

- By material, the synthetic fiber segment represented over 70.30% of total revenue in 2021. This segment's dominance is due to the high demand for synthetic fibers, which are known for their durability, strength, resilience, and resistance to environmental challenges such as moisture and fungi. Additionally, synthetic fibers are easier to handle and manufacture, often being more cost-effective than natural alternatives.

- In terms of type, the knitted agro textile segment led the market in 2021, accounting for more than 47.80% of overall revenue. Knitted fabrics are used in various applications, including impact protection through wind control, hail protection, and bird nets. Their versatility and ease of handling have significantly increased product demand.

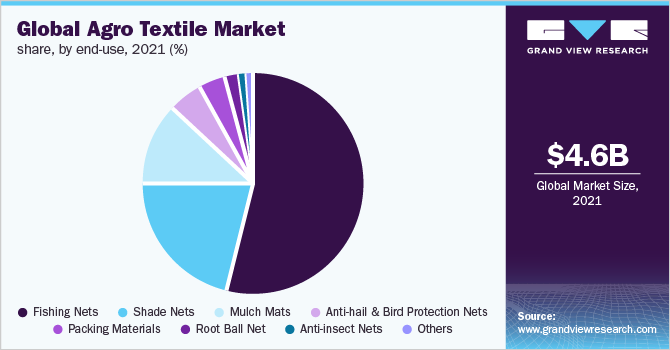

- By end use, fishing nets accounted for the largest share in 2021, exceeding 54.00% of overall revenue. The growing use of aquatic life in industries such as nutraceuticals, pharmaceuticals, and cosmetics, combined with rising seafood consumption, has fueled the growth of aquaculture and, consequently, the fishing net segment. Shade nets are selected based on the crops grown beneath them, depending on the light tolerance of each crop.

Market Size & Forecast

- 2021 Market Size: USD 4.62 Billion

- 2030 Projected Market Size: USD 6.98 Billion

- CAGR (2022-2030): 4.7%

- Asia Pacific: Largest market in 2021

Key Companies & Market Share Insights

Major players in the agro textile market are forming agreements with emerging and small-scale companies to enhance their distribution capabilities and expand market reach. Manufacturers are also focusing on efficient distribution channels to ensure timely access for buyers. Prominent market players have been evaluated based on their geographical reach, distribution networks, product portfolios, innovation, strategic developments, operational capabilities, and brand presence in the market.

Key Players

- TenCate Industrial Fabrics

- Garware Technical Fabrics

- Freudenberg Performance Materials

- Beaulieu Technical Textiles

- Belton Industries, Inc.

- Diatex SAS

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The agro textile market is poised for steady growth, driven by the increasing demand for agricultural productivity and sustainable practices. As the global population continues to rise, the need for effective agro textiles that enhance crop quality and protect against environmental factors will remain critical. With significant opportunities in the Asia Pacific region and advancements in synthetic materials, the industry is well-positioned for expansion. As governments promote sustainable agricultural practices, the adoption of agro textiles is expected to rise, further supporting market growth in the coming years.