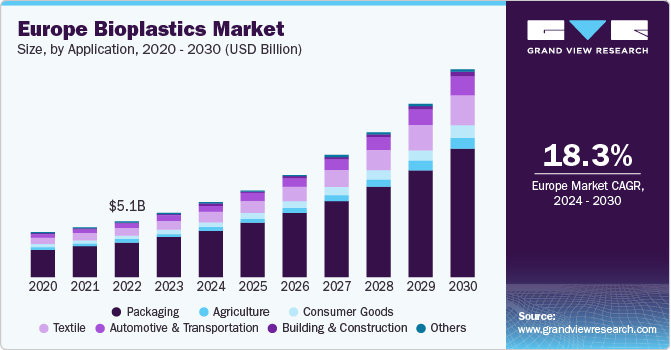

The Europe bioplastics market was valued at USD 5.82 billion in 2023 and is expected to grow to USD 18.84 billion by 2030, registering a CAGR of 18.3% from 2024 to 2030. Bioplastic packaging offers a sustainable and visually appealing alternative for improved packaging solutions. The rapid expansion of Europe's food industry has significantly driven the demand for flexible packaging solutions. Furthermore, the rising popularity of nutraceutical products and regulatory support from the European Commission concerning the use of polymers in food packaging applications are anticipated to further boost the bioplastics market.

Growth in Europe's healthcare sector is also expected to fuel demand for pharmaceuticals, thereby increasing the need for flexible packaging and positively influencing bioplastics market growth. Polylactic acid (PLA) finds application in medical implants such as plates, rods, pins, screws, and anchors. Europe is poised for substantial growth owing to the increasing adoption of PLA and the rising demand for biocompatible polymers and 3D printing filaments in the medical field.

The market is governed by strict regulatory standards including EN 13432, EN 14995, EN 17033, EN 14045, ISO 18606, and ISO 17088. The European Association has established a certification system that categorizes products and packaging based on their content. Products certified under this system receive the “OK biodegradable” label. In July 2022, Asahi Kasei Corporation announced its membership in the European Bioplastics (EUBP) association, which is dedicated to enhancing the regulatory framework to support the growth of the bioplastics market in Europe.

Order a free sample PDF of the Europe Bioplastics Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Regional Consumption: The Rest of Europe region accounted for the largest consumption of bioplastics in 2023, holding a revenue share of 52.36%. This is driven by continuous innovation and sustainability initiatives in countries such as Italy, Spain, and Poland. For example, in October 2023, Italian design company Medarrch launched 3D-printed bioplastic furniture made from eco-friendly materials including corn sugar and renewable, non-petroleum derivatives.

- Application: Packaging led the market in 2023 with a 62.39% revenue share. In this sector, bioplastics are predominantly used in food and beverage packaging. Fresh food items are packed using bioplastic bottles, jars, and containers. PLA plastics are favored due to their high-gloss finish and durability, especially in single-use bottle production.

- Product Type: Biodegradable bioplastics accounted for the largest revenue share of 51.59% in 2023. Growth in this segment is supported by the future policy framework for biodegradable plastics under the EU's Green Deal and Circular Economy Action Plan. Biodegradable bioplastics have strong potential to drive innovation, foster a circular bioeconomy, and attract new investments.

Market Size & Forecast

- 2023 Market Size: USD 5.82 Billion

- 2030 Projected Market Size: USD 18.84 Billion

- CAGR (2024-2030): 18.3%

Key Companies & Market Share Insights

The Europe bioplastics market is highly competitive, with established players such as Sabic, BASF SE, and Avantium N.V. leading the industry. These companies are actively pursuing strategic initiatives including mergers and acquisitions, partnerships, and collaborations to maintain and strengthen their market positions.

Key Players

- BASF SE

- Carbios

- Biome Bioplastics

- Braskem S.A.

- Novamont S.P.A.

- Sabic

- Teijin Limited

- Toray Industries, Inc.

- Total Corbion PLA

- Avantium N.V.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The Europe bioplastics market is set to experience robust growth through 2030, driven by increasing demand from the food and healthcare sectors and strong regulatory support promoting sustainability. The rise of nutraceuticals and innovations in bioplastic applications, especially in packaging and medical uses, underpin this expansion. Strict regulatory frameworks and certification systems ensure product quality and environmental compliance, further encouraging market growth. With significant contributions from key players and ongoing technological advancements, Europe is poised to lead the global transition toward sustainable bioplastic solutions, fostering a greener and more circular economy.