The Europe disposable syringes market was valued at USD 2,374.16 million in 2022 and is projected to reach USD 3,647.92 million by 2030, growing at a CAGR of 5.75% from 2023 to 2030. This market expansion is driven by the increasing incidence of chronic diseases, rising use of safety syringes, a surge in Hospital-Acquired Infections (HAIs), and a growing number of surgeries across Europe.

Chronic illnesses such as cardiovascular diseases, cancer, urological disorders, strokes, renal and neurovascular conditions are becoming increasingly prevalent in the region. Non-communicable diseases (NCDs) now account for 80% of the disease burden in EU countries and are a leading cause of preventable premature deaths. Contributing factors include high blood pressure, smoking, obesity, sedentary lifestyles, excessive alcohol use, and diabetes.

The European Chronic Disease Alliance (ECDA) in its 2021 report cited that cardiovascular disease (CVD) claims 3.9 million lives annually in Europe, including over 1.8 million deaths in the EU alone. Meanwhile, though Europe makes up only about one-eighth of the global population, it accounts for nearly one-quarter of all cancer diagnoses, with 3.7 million new cases each year. Lung, breast, stomach, liver, and colon cancers remain the most common, with lung cancer alone accounting for one-fifth of cancer-related deaths in the EU.

The aging population across Europe is also a significant driver of market growth, as older adults are more susceptible to chronic diseases such as diabetes, which necessitates frequent use of disposable syringes. The cumulative effect of these factors is expected to substantially boost the demand for disposable syringes in Europe over the forecast period.

Order a free sample PDF of the Europe Disposable Syringes Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- By Country: Germany led the European disposable syringes market in 2022, accounting for over 16.30% of the total revenue. Its healthcare system operates on four foundational principles—compulsory insurance, solidarity, self-governance, and insurance-funded services—making treatments more accessible and increasing demand for medical supplies like syringes.

- By Product Type: Safety syringes dominated the market in 2022, comprising 64.06% of total revenue. These syringes are widely used due to their role in preventing infections from unsafe injection practices, which globally cause over 33,800 HIV, 315,000 hepatitis C, and 1.7 million hepatitis B infections annually.

- By End Use: Hospitals emerged as the largest end users, holding 35.56% of the revenue share in 2022. Hospitals are the primary consumers due to their bulk usage, long-term contracts with syringe suppliers, and reliance on after-sales services.

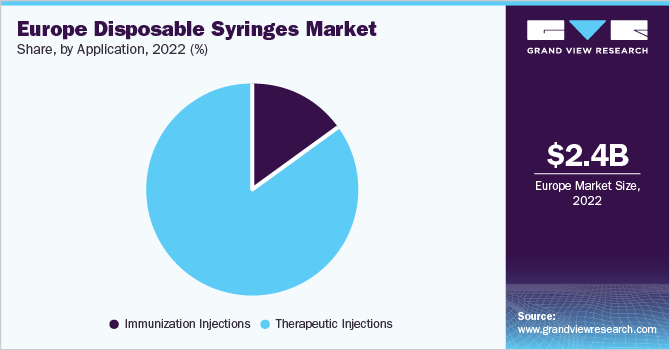

- By Application: Therapeutic injections led the market by revenue in 2022. A major contributor to this growth is the increased awareness around blood donation in Europe. According to WHO, blood donations range from 6 to 67.6 per 1,000 people, with Denmark recording the highest rates. Injections remain central to nearly every medical treatment, from diagnostics to therapies.

Market Size & Forecast

- 2022 Market Size: USD 2,374.16 Million

- 2030 Projected Market Size: USD 3,647.92 Million

- CAGR (2023-2030): 5.75%

- Germany: Largest market in 2022

- Denmark: Fastest growing market

Key Companies & Market Share Insights

The European disposable syringes market is highly competitive. Manufacturers are prioritizing regulatory approvals and product certifications to scale mass production. A key concern in healthcare settings is accidental needle stick injuries, prompting manufacturers to innovate and adopt safer syringe technologies.

To strengthen their market position, players are investing in partnerships, product launches, and acquisitions. For instance, in June 2021, BD (Becton, Dickinson and Company) secured pandemic orders for 2 billion syringes and needles to support global COVID-19 vaccination campaigns. These orders came from countries including the U.S., Germany, France, Spain, the U.K., and several others, as well as non-governmental organizations supporting vaccination efforts in developing regions. BD is now supporting over 40 countries and organizations with pandemic-related syringe needs.

Key Players

- Cardinal Health

- B. Braun Melsungen

- Terumo Corporation

- ICU Medical, Inc. (Smiths Medical)

- Nipro Corporation

- BD

- Sol-Millennium Medical

- CODAN Medizinische Geräte GmbH & Co KG

- Cole-Parmer Instrument Company, LLC.

- Henke-Sass, Wolf

- UltiMed, Inc.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The Europe disposable syringes market is poised for steady growth through 2030, driven by a rising burden of chronic diseases, aging population, increased surgical procedures, and the widespread push for infection control through safer medical practices. Countries like Germany and Denmark are leading market contributors due to robust healthcare systems and high awareness around preventative care, such as vaccinations and blood donations. With the healthcare sector emphasizing safety and efficiency, and major manufacturers responding with strategic partnerships and innovation, the demand for disposable syringes is expected to remain strong. Regulatory support and growing public health awareness will further cement the role of disposable syringes in modern European healthcare delivery.