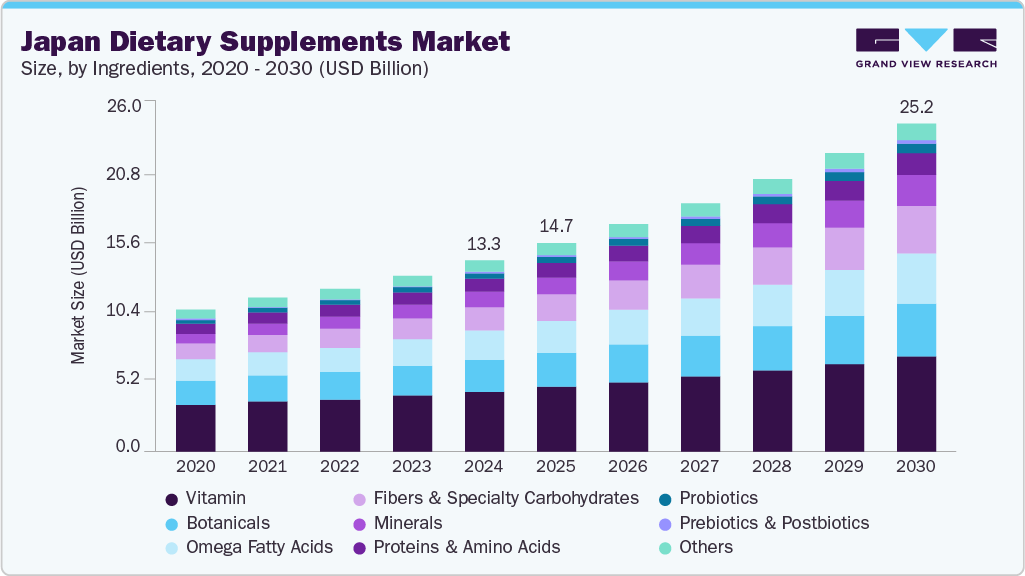

The Japan dietary supplements market was valued at USD 13.32 billion in 2024 and is projected to grow to USD 25.24 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of 11.3% from 2025 to 2030. The growth of this market is primarily driven by the rising adoption of dietary supplements among the aging population, a growing focus on health and wellness, and high levels of health awareness in Japan. Additionally, the increasing demand for beauty products and anti-aging treatments is further contributing to market expansion.

Health and wellness awareness in Japan is on the rise, with many consumers adopting healthier diets and fitness regimens. As part of these changes, there is a growing trend to incorporate dietary supplements into daily routines, increasing the demand for multivitamins, protein powders, prebiotics, and probiotics. The ease of access to information about supplements is also playing a significant role in boosting consumption across the country.

Japan's large geriatric population is another key driver of dietary supplement demand. In 2023, approximately 31.7% of Japan's population was aged 65 or older, contributing to a growing need for supplements targeting gut health, anti-aging, and weight management. Furthermore, the increasing prevalence of chronic diseases such as Chronic Obstructive Pulmonary Disease (COPD), cancer, arthritis, and chronic kidney disease is expected to further drive demand for dietary supplements. In 2022, Japan recorded nearly 1,005,157 new cancer cases, as reported by the International Agency for Research on Cancer, underscoring the importance of supplements in disease prevention and management.

Shifting lifestyles, especially in key urban centers like Tokyo, Yokohama, Osaka, and Nagoya, are also influencing the consumption of dietary supplements. Many urban residents are increasingly turning to supplements to fill nutritional gaps in their diets. The convenience offered by innovative product packaging and easy-to-consume formats, such as tablets and gummies, is further boosting demand, particularly among working professionals and young adults.

Order a free sample PDF of the Japan Dietary Supplements Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- Vitamin Segment Dominance: The vitamin segment led the market in 2024, accounting for 29.2% of the revenue share. Multivitamins and other vitamin supplements are widely consumed by various age groups across Japan. There is a growing demand for products that support gut health, chronic disease management, and preventive health, driving innovation in new product offerings.

- Tablets as Preferred Form: Tablets accounted for the largest revenue share in 2024. This format is popular due to its ease of use for consumers and storage convenience for businesses. Tablets are commonly used because they are simple to consume, and after ingestion, they undergo a process of dissolution and absorption, ensuring effective nutrient delivery.

- Over-the-Counter (OTC) Segment Leadership: The OTC segment dominated the market with the largest revenue share in 2024. The growth of this segment is fueled by increasing consumer demand for self-care nutritional supplements, especially for anti-aging, immunity enhancement, and general nutritional gaps.

- Immunity Boosting as Key Application: The immunity segment led the market in 2024, driven by high stress, pollution, and changing lifestyle patterns in urban Japan. Younger adults and working professionals in cities are especially inclined to consume supplements that support immune function.

- Adult Segment's Growing Influence: The adult segment accounted for 62.8% of the revenue share in 2024. This is primarily attributed to the rising demand for supplements such as multivitamins, omega-rich products, protein powders, and skin health supplements. A significant portion of the adult population, across multiple generations including millennials, Gen X, and Gen Z, is shifting its dietary habits toward healthier food intake.

- Offline Distribution Channel Dominance: The offline distribution segment held the largest revenue share in 2024, driven by the widespread accessibility of dietary supplements through supermarkets, pharmacies, and specialty stores. The aging population's preference for in-person shopping also significantly contributes to this segment's growth.

Market Size & Forecast

- 2024 Market Size: USD 13.32 Billion

- 2030 Projected Market Size: USD 25.24 Billion

- CAGR (2025-2030): 11.3%

Key Companies & Market Share Insights

Leading players in Japan's dietary supplements market include Meiji Holdings Co., Ltd., DHC Corporation, Otsuka Pharmaceutical Co., Ltd., and Amway Japan GK, among others. To stay competitive and address evolving consumer preferences, these companies are focusing on strategies such as product innovation targeted at specific user groups, packaging enhancements, widespread distribution networks, and collaborations with other organizations.

- Meiji Holdings Co., Ltd. offers a broad portfolio of products, including dairy items, confectioneries, and nutritional products. The company is known for its protein solutions, infant and children's nutrition, and beauty supplements.

- Abbott Japan Co., Ltd., a subsidiary of Abbott Laboratories, provides a wide range of nutritional products such as Glucerna REX, Glucerna REX1.5, Abando, and Pulmocare EX. Abbott leverages a large distributor network and e-commerce channels to reach consumers throughout Japan.

Key Players

- Meiji Holdings Co., Ltd.

- DHC Corporation

- Otsuka Pharmaceutical Co., Ltd.

- Amway Japan GK

- Abbott Japan Co., Ltd.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The Japan dietary supplements market is set for substantial growth, driven by the increasing health-consciousness of the population, particularly the aging demographic, and the rising demand for supplements targeting gut health, immunity, and anti-aging. Urban lifestyles, coupled with growing awareness of dietary supplements, are contributing to the market's expansion. The strong dominance of vitamins, tablets, and OTC products, along with the popularity of immunity-boosting supplements, reflects the shifting consumer preferences toward self-care and preventive health. Companies are actively innovating in product offerings and expanding distribution channels to meet the growing demand. The market is poised to continue growing at a robust pace, with the projected market size expected to nearly double by 2030.