The global remittance market was valued at approximately USD 48.99 billion in 2021 and is projected to reach USD 107.80 billion by 2030, growing at a compound annual growth rate (CAGR) of 10.1% from 2022 to 2030. Cross-border remittances provide significant economic benefits, including enhanced financial inclusion and economic development. For migrants and their families, remittances represent a crucial source of income, typically spent on essential needs such as medications, education, food, and housing.

Traditionally, sending money abroad has been a time-consuming and costly process, characterized by numerous intermediaries, hidden fees, and extensive paperwork. However, recent advancements in the industry have allowed individuals and small-to-medium-sized businesses to access cheaper, faster, and more efficient foreign fund transfer services. Historically, large corporations, banks, and governments have benefited from direct access to the institutional foreign exchange market, which has fueled growth in the remittance sector.

Moreover, new entrants into the remittance market are intensifying competition, leveraging fees as a key differentiator to attract customers and enhance convenience and affordability. Established players are capitalizing on the capabilities of digital platforms and benefiting from lower fixed costs. Their modern technological and operational infrastructures enable faster turnaround times and lower fees, making remittances accessible to a wider audience. Additionally, many market participants are forming partnerships with innovative fintech companies to broaden their regional reach.

Order a free sample PDF of the Remittance Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- North America led the remittance market in 2021, accounting for over 24.0% of the revenue share. This dominance is due to the presence of prominent players such as Bank of America Corporation and Citigroup, Inc. Additionally, fintech companies in North America are actively collaborating with major players to leverage their strengths.

- By mode of transfer, the traditional (non-digital) segment held the largest revenue share of over 75.0% in 2021. Traditional remittance methods, which include cheques and ATMs, are preferred by consumers for their perceived security and safety. Prior to the rise of digital channels, these methods were the only available options for international remittances, justifying their significant market share.

- In terms of type, the outward remittance segment dominated the market in 2021, accounting for over 54.0% of the revenue share. Outward remittances facilitate global transactions, allowing businesses to capitalize on opportunities that may not be available otherwise.

- By channel, the money transfer operators segment represented the largest revenue share of over 50.0% in 2021. While bank fees vary based on destination and specific bank policies, many money transfer operators offer flat rates, making international transfers more affordable.

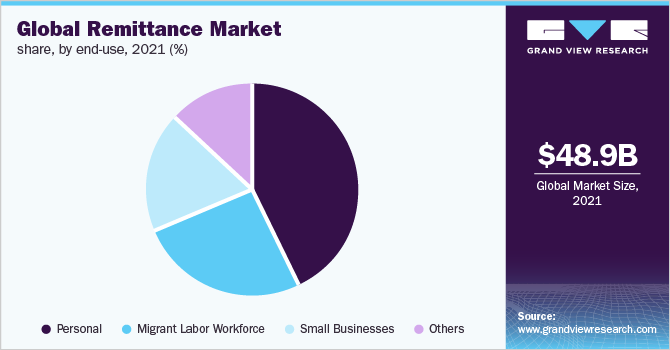

- In terms of end-use, the personal remittance segment accounted for more than 42.0% of the global revenue share in 2021. Personal remittances encompass all financial transactions between resident and non-resident parties, including both migrants and non-migrants.

Market Size & Forecast

- 2021 Market Size: USD 48.99 Billion

- 2030 Projected Market Size: USD 107.80 Billion

- CAGR (2022-2030): 10.1%

- North America: Largest market in 2021

- Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

Prominent players in the remittance market are employing various strategies, including research and development initiatives, product innovations, joint ventures, strategic partnerships, expansions, and mergers & acquisitions to gain a competitive edge. Many companies are leveraging the capabilities of newly emerged fintech firms to provide customers with convenient remittance solutions. For instance, in August 2022, Currencycloud collaborated with Future FinTech (FTFT) Labs to launch the remittance application, Tempo, for U.S. immigrants. This partnership enables FTFT Labs to offer customers a multi-currency wallet with competitive fees.

Additionally, vendors are focusing on expanding their presence in the remittance market. For example, in December 2022, Mastercard partnered with Credit Libanais, a Lebanese bank, to facilitate inward cross-border payments via direct bank deposits. This collaboration aims to enhance international payment processes for the bank's customers. Such initiatives and partnerships among key market players are driving the growth of the remittance market.

Key Players

- Bank of America Corporation

- ZEPZ

- Citigroup, Inc.

- Ria Financial Services, Inc.

- OFX

- Wells Fargo

- Western Union Holdings, Inc.

- PayPal

- MoneyGram International, Inc.

- Wise US, Inc.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The remittance market is poised for significant growth, driven by the increasing demand for cross-border financial services and the ongoing advancements in technology that enhance the efficiency and affordability of money transfers. As competition intensifies and new players enter the market, consumers will benefit from improved services and lower fees. With a strong emphasis on financial inclusion and the economic importance of remittances for migrant households, the market is well-positioned for continued expansion in the coming years. As regions like Asia Pacific experience rapid growth, the overall landscape of the remittance market will evolve, offering new opportunities for innovation and collaboration.