U.S. C5ISR Market Overview

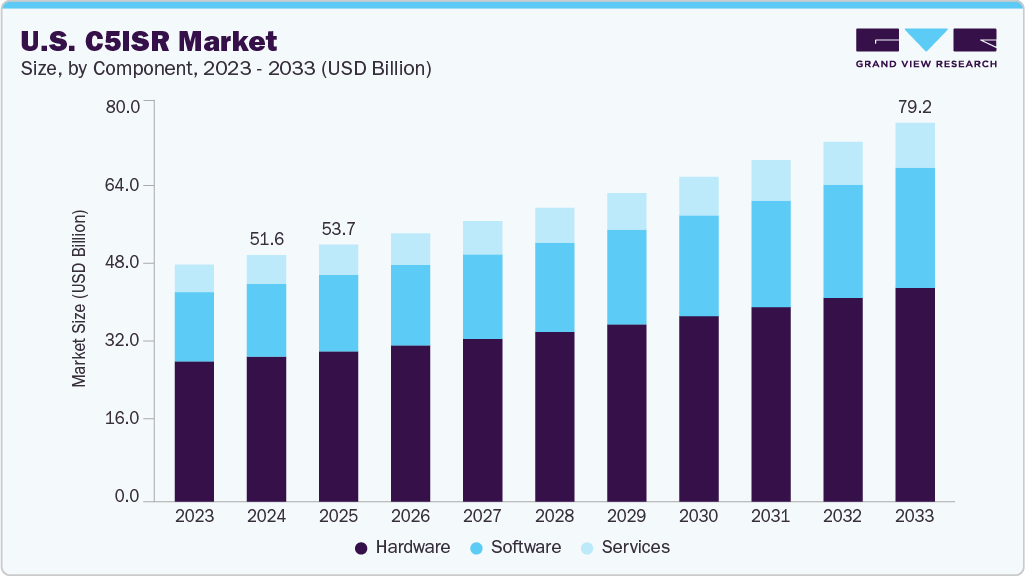

The U.S. C5ISR market was estimated at USD 51.59 billion in 2024 and is projected to reach USD 79.24 billion by 2033, growing at a CAGR of 5.0% from 2025 to 2033. This growth is primarily fueled by intensifying geopolitical tensions, expanding defense modernization programs, and a rising need for integrated battlefield awareness and real-time intelligence capabilities.

The increasing emphasis on national security and situational awareness across defense and homeland security sectors continues to drive market expansion. Governments are significantly investing in modern military infrastructure and adopting integrated C5ISR systems to enhance decision-making, coordination, and responsiveness on the battlefield. In particular, the demand for real-time data exchange, advanced surveillance systems, and secure communications networks is surging across both defense forces and border security operations.

Furthermore, the drive for platform interoperability, alongside the integration of artificial intelligence (AI) and machine learning (ML) for data analysis and decision-making, is accelerating the adoption of advanced C5ISR systems. These technologies not only improve threat detection and operational efficiency but also enable autonomous responses and enhanced threat situational awareness.

Order a free sample PDF of the U.S. C5ISR Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- By Component – Hardware: In 2024, the hardware segment led the market, accounting for over 58% of the revenue share. This is attributed to continued investments in modernizing defense infrastructure and the procurement of cutting-edge equipment such as tactical communications systems, radars, and advanced sensors. These tools are crucial for delivering resilient and reliable communication in high-stakes operational environments.

- By Application – Intelligence, Surveillance, and Reconnaissance (ISR): The ISR segment captured the largest revenue share of 45.8% in 2024. The growing requirement for real-time intelligence gathering—especially via platforms like satellites, UAVs, and ground-based sensors—is vital for strategic defense missions. These technologies support faster and more informed decision-making during active operations.

- By End Use – Air Domain: The air segment dominated the market in 2024, holding a 35.2% share. This reflects the increasing use of airborne ISR systems such as UAVs, reconnaissance aircraft, and airborne radar for intelligence gathering in remote or contested areas. The capability of air-based platforms to provide persistent surveillance and rapid response continues to position them as a critical part of modern military strategies.

Market Size & Forecast

- 2024 Market Size: USD 51.59 Billion

- 2033 Projected Market Size: USD 79.24 Billion

- CAGR (2025-2033): 5.0%

Key Companies & Market Share Insights

Several leading defense contractors and emerging players are shaping the U.S. C5ISR market with their technological advancements and strategic initiatives:

- Lockheed Martin Corporation: Lockheed Martin is a dominant force in the defense sector, offering an array of integrated C5ISR platforms, including space-based ISR systems, command and control platforms, tactical communications, and AI-powered decision tools. Programs like the Aegis Combat System and SBIRS (Space-Based Infrared System) demonstrate the company's leadership in delivering advanced situational awareness across all military domains.

- Northrop Grumman: Northrop Grumman is recognized for its expertise in C5ISR integration, particularly with unmanned aerial systems, electronic warfare, and cyber-secure communication systems. Solutions such as the Global Hawk and BACN (Battlefield Airborne Communications Node) are critical assets for ensuring seamless intelligence gathering and coordinated command in joint force operations.

Emerging Participants

- Kratos Defense & Security Solutions, Inc.: Kratos is gaining recognition for delivering cost-effective C5ISR solutions, especially in the domains of unmanned systems, electronic warfare, and satellite communications. Its Valkyrie autonomous drone and rapid-deploy communications systems are tailored for modern, high-threat environments.

- CACI International Inc.: CACI focuses on providing advanced C5ISR services with a strong emphasis on signals intelligence (SIGINT), electronic warfare, and cybersecurity infrastructure. The firm supports multi-domain operations by delivering agile, secure systems to the U.S. Army and the intelligence community.

Key Players

- Lockheed Martin Corporation.

- Northrop Grumman.

- General Dynamics Corporation

- L3Harris Technologies, Inc.

- Leidos

- Raytheon Technologies Corporation

- BAE Systems

- CACI International Inc

- ADS

- Kratos Defense & Security Solutions, Inc.

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. C5ISR market is poised for steady expansion, with a projected market size of USD 79.24 billion by 2033 and a CAGR of 5.0% between 2025 and 2033. This growth is underpinned by increasing global security threats, ongoing defense modernization efforts, and technological advancements in areas like AI, machine learning, and secure communication systems.

As geopolitical dynamics evolve, the demand for real-time intelligence, interoperability across forces, and cyber-resilient infrastructures is set to rise. Market leaders such as Lockheed Martin and Northrop Grumman, along with innovative players like Kratos and CACI, are well-positioned to meet the changing needs of defense and intelligence agencies. With strong government backing and technological integration, the U.S. C5ISR sector is expected to remain a cornerstone of national security and defense capabilities in the years ahead.