U.S. Internet of Things (IoT) Market Overview

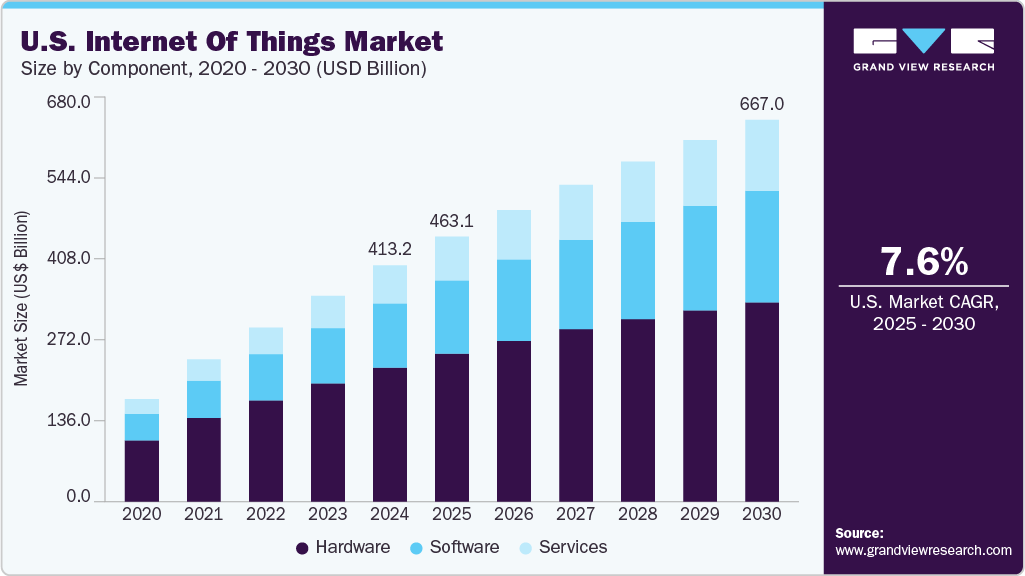

The U.S. Internet of Things (IoT) market was valued at USD 413.22 billion in 2024 and is projected to reach USD 667.01 billion by 2030, growing at a CAGR of 7.6% from 2025 to 2030. This growth is primarily driven by increasing demand for smart devices, expanding adoption of Industrial IoT (IIoT) in manufacturing, and strong government support for smart city and infrastructure initiatives. Key industries such as retail, healthcare, and agriculture are rapidly integrating IoT technologies, supported by a robust presence of major technology providers in the U.S., thereby fueling further expansion of the market.

A significant growth factor is the integration of artificial intelligence (AI) and cloud/edge computing into IoT ecosystems. These technologies enable real-time data analysis, automation, and scalable deployments, accelerating digital transformation across industries. By applying AI algorithms, IoT systems can process large volumes of sensor data to make intelligent, automated decisions. This is enhancing predictive maintenance, improving operational efficiency, and enabling proactive interventions in critical sectors like healthcare, logistics, and manufacturing.

Moreover, the rollout of 5G and low-power wide-area networks (LPWAN) such as LTE-M and NB-IoT is enhancing IoT connectivity. These networks offer low latency, wide coverage, and energy-efficient communication—essential for use cases in smart cities, connected vehicles, and industrial automation. The emergence of private 5G networks and multi-profile eSIMs is further enabling secure and scalable IoT deployments across the U.S.

Order a free sample PDF of the U.S. Internet Of Things Market Intelligence Study, published by Grand View Research.

Key Market Trends & Insights

- By Component: The hardware segment accounted for over 56% of the market share in 2024, driven by the proliferation of 5G and edge computing technologies. These advances enable real-time device communication, essential for applications like autonomous vehicles and smart factories.

- By Deployment: The on-premises segment led the market in 2024, primarily due to increased requirements for data privacy, low latency, and regulatory compliance in sectors such as healthcare, defense, and manufacturing. On-premises solutions provide organizations with greater control over sensitive data and processing environments.

- By Connectivity: Wi-Fi held the largest revenue share in 2024, owing to its widespread availability and increasing investment in digitization and smart technologies. It delivers seamless, high-speed connectivity for a broad range of IoT devices.

- By End Use: The consumer electronics segment captured the largest market share in 2024, driven by rising demand for smart home devices like thermostats, security systems, and voice assistants, as well as wearables such as smartwatches and fitness trackers that support health and lifestyle applications.

Market Size & Forecast

- 2024 Market Size: USD 413.22 Billion

- 2030 Projected Market Size: USD 667.01 Billion

- CAGR (2025-2030): 7.6%

Key Companies & Market Share Insights

Several major players and emerging companies are shaping the U.S. IoT market landscape:

- Amazon.com, Inc.: Through AWS IoT, Amazon offers an extensive suite of services that allow organizations to build, manage, and analyze IoT applications at scale. The platform supports large-scale device deployments with high message throughput, integrated AI capabilities, and multilayered security.

- Cisco Systems, Inc.: Cisco provides comprehensive IoT solutions across industrial, transportation, and smart city sectors. Their technologies enable secure connectivity, real-time analytics, and robust edge-to-cloud data flows, even in harsh environments, supporting scalable deployments.

- AT&T: A key player in secure and reliable IoT connectivity, AT&T provides a wide array of IoT solutions across manufacturing, transportation, and healthcare sectors. Their offerings include edge computing, device management, and a broad ecosystem of pre-certified devices.

- Celona, Inc.: An emerging U.S.-based company, Celona focuses on private 5G networks for enterprise IoT applications. Their turnkey solutions are designed for industrial automation, smart buildings, and low-latency environments, offering enhanced control, performance, and security.

Key Players

- AT&T

- Celona, Inc.

- SAP SE

- PTC Inc.

- Cisco Systems, Inc.

- IBM Corporation

- Microsoft Corporation

- Intel Corporation

- Siemens AG

- Amazon Web Services (AWS)

- Oracle Corporation

- General Electric Company (GE)

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The U.S. Internet of Things (IoT) market is set for robust growth through 2030, propelled by advancements in connectivity, AI integration, and edge computing. As industries increasingly adopt smart technologies to improve efficiency and decision-making, the demand for IoT solutions across sectors such as manufacturing, healthcare, and consumer electronics continues to rise. With a strong foundation in 5G and increasing support for private networks and AI-driven insights, the market is positioned for significant innovation and value creation. The presence of leading technology firms and supportive regulatory frameworks further reinforces the U.S. as a global leader in IoT adoption and deployment.